Provide liquidity in Strategies and passively earn the highest APY in DeFi market

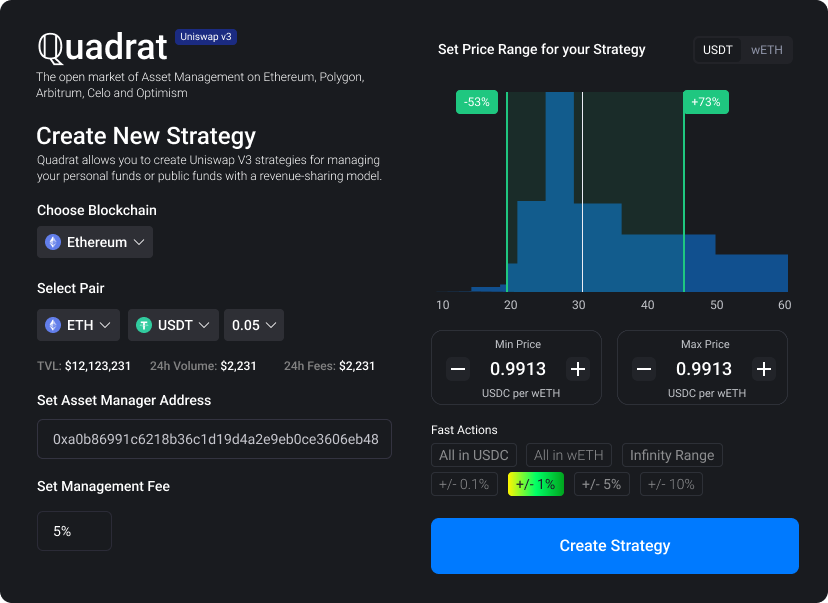

Create your strategy, manage liquidity and earn fees

Professional tools for Web3 Asset Managers and Crypto Funds

Quantam uses an automated liquidity pool's price range management, reduces the risk of impermanent losses, rebalances assets and reinvests earned fees for optimal APY. This approach is superior to the passive option of providing liquidity. This method ensures that the pool consistently provides liquidity to the crypto market by controlling the value and ratio of the respective tokens as demand grows. In addition, the self-storage of Quantam LP tokens that are issued in exchange for liquidity allows you to control your personal funds fully. Thus, the risk associated with centralized exchanges, where you can lose your funds if the exchange is hacked or goes bankrupt, is completely absent. Quantam proposes to invest in liquidity pools passively most efficiently, where the algorithm does all the active work on-chain.

Automated

Automate your liquidity management and passively earn the highest APY

Non-custodial

All the funds are directly stored in Uniswap v3 Pools and the asset manager doesn't have access to it

Permissionless

On-chain protocol is managed by Quantam Governance and can be used by anyone

Composable

Strategy LPs could be used as collateral in lending and liquidity farming protocols

Quantam

finance

Quantam is a censorship-resistant and permissionless protocol for DeFi users and liquidity Asset Managers. Quantam DAO manages vaults with its verified "0xPlasma" Strategies. The creation and management of the strategy is very flexible and powerful. DeFi Fund and Asset Managers can create Uniswap v3 strategies with advanced tools of the Quantam Protocol.

Quantam Strategy Vaults

Follow Range

Backtest: ~50% APY

Liquidity is provided evenly within the active price range and follows it through rebalancing, automatic fee collection and reinvestment in the range with protection of impermanent loss.

Implied Volatility

Backtest: ~100% APY

Using an estimated range extraction of implied volatility to provide liquidity, having as parameter protection against impermanent loss.

Option Squeeze

Backtest: ~150% APY

The liquidity position will never expire. The liquidity position will behave like a "perpetual" covered call option. We automate option strategy by rebalancing and setting a stop loss into a more liquid asset.

Lending Strategy

Backtest: ~30 0% APY

You can provide liquidity to any of the strategies and receive pool tokens in return, which can be used as collateral for obtaining a loan, this method allows you to leverage your share in the pool position and receives a higher income.

Quantum Uniswap v3 Rebalancer

One-click and instant Uniswap v3 Rebalancer is optimizing your liquidity management. You can also use Quantam Protocol to rebalance your own liquidity in Uniswap v3 positions. Quantam Rebalancer does not use NFT positions and interacts directly with Uniswap v3 smart contracts, which saves you a lot of gas fees.

Features and Tools for professional Uniswap v3 Asset Managers and Hedge Funds

Whitelist

Create public and private strategy vaults with a whitelist of investors

PnL Tracker

Track your vault portfolio PnL and APY in real-time

API Platform

Get access to a rebalancing of your strategies via API service

Data Platform

Get the real-time data of all the vaults and Uniswap v3 pools via our Data Platform and Subgraphs

Quantam Protocol Roadmap

Blockchains

Ethereum

Polygon

Optimism

Arbitrum

0xPlasma Strategies

Follow Range

Implied Volatility

Option Squeeze

Leverage Position

AI-based Strategies

"Black Swan" Strategies

Forex Strategies

Web3 Platform

Manager ENS Social Profile

Managers Leaderboard

Strategy Customization

Strategy Limit Orders

Delta Neutral Strategies

Dev Platform

Analytics Platform

API Gateway

Backtesting Tools

Hedging Tools

Protocol Yield Farming Model

Quantam token holders own and govern the protocol. Protocol Perfomance Fee - 2.5%. 1/2 of protocol fees goes to Governance Treasury and 1/2 to 0xPlasma Labs management team

-

Uniswap Fees

-

Manager Fees

-

Protocol Fees

-

Incentivisation

Quantam

NFT Pass

The First NFT with an Access to DeFi Protocol and the Highest Yield

Quantam

DAO

Quantam token holders own and govern the Quantam Protocol

Quantam's Decentralized Autonomous Organization will expand the web 3.0 space by unifying the competition between protocols for capital efficiency and governance tools. Governance in the DAO involves creating a competitive environment for the community to develop tools by evaluating and testing the applied strategies to improve the efficiency of capital.

Quantam NFT Pass

Access to UI, Protocol and Strategies will be able only for Quantam NFT Pass holders. The total emission of NFT will be 10.000 units.

Earn yield from Protocol Performance

By Staking $POOL token, you will participate in monthly yield distribution from the protocol and strategies performance.

$POOL Token

A token is a key tool for DAO management and decision-making, token holders determine the listing of verified pools and check strategies for effectiveness, as well as tools for rebalancing and changing contract parameters. Quantam protocol receives a commission from the income of vaults strategies, the income is directed to burning tokens by buying from token exchange pools, thereby providing a market deficit of the token in active trading markets.

Token Distribution

$POOL Token will be fair distributed between holders of Quantam NFT Pass, asset managers and liquidity providers.